EIN Numbers Explained: What They Are, Who Needs One, and How to Get Yours

Your EIN is the foundation of your business’s legitimacy — and it’s free to get. Here’s why it matters, who needs it, and how to apply in under 10 minutes.

Your EIN is the foundation of your business’s legitimacy — and it’s free to get. Here’s why it matters, who needs it, and how to apply in under 10 minutes.

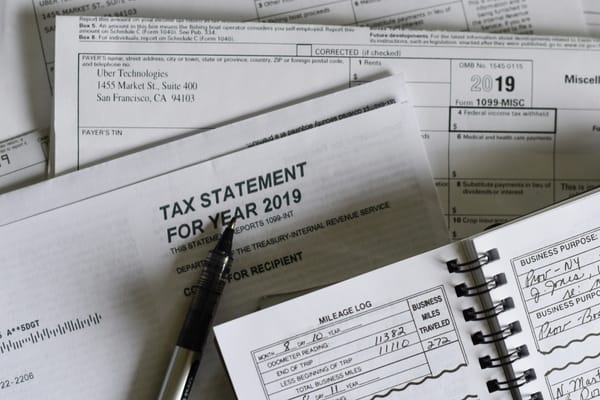

You’ve probably seen “EIN” on forms, grant applications, and tax paperwork — but what exactly is it, and why does everyone say you need one?

An EIN (Employer Identification Number) is a unique nine-digit number issued by the IRS to identify your business for tax purposes. Think of it as your business’s Social Security number — it tells the government your business exists and helps you operate legitimately.

Even if you don’t have employees, you likely still need an EIN if you:

EIN: Used to identify a business entity.

SSN: Used to identify an individual taxpayer.

If you’re currently using your SSN for business forms or client invoices, switch to an EIN. It protects your identity and builds credibility when applying for funding or partnerships.

Myth vs. Fact

Myth: Only big businesses need EINs.

Fact: Freelancers, side-hustlers, and single-member LLCs all benefit from having one.

The best part? It costs nothing and takes about 10 minutes.

Here’s how you do it:

Go to the official IRS website: https://sa.www4.irs.gov/applyein/

You’ll need your EIN when you:

✅ Apply for your EIN directly through the IRS (free).

✅ Save your EIN confirmation letter securely.

✅ Update your business bank and payment profiles with your EIN.

✅ Use your EIN instead of your SSN for all official business documents.

|